Strategies for Cost-Effective Offshore Business Formation

When considering offshore firm development, the quest for cost-effectiveness ends up being a paramount issue for services looking for to expand their operations globally. In a landscape where fiscal vigilance rules supreme, the methods used in structuring offshore entities can make all the difference in achieving monetary effectiveness and functional success. From browsing the intricacies of territory option to implementing tax-efficient structures, the journey towards establishing an offshore existence is swarming with difficulties and chances. By checking out nuanced techniques that mix lawful conformity, monetary optimization, and technological improvements, organizations can get started on a path in the direction of offshore company development that is both financially sensible and tactically noise.

Picking the Right Territory

When establishing an overseas business, selecting the ideal territory is an important decision that can dramatically affect the success and cost-effectiveness of the formation procedure. The jurisdiction picked will determine the governing framework within which the firm runs, impacting taxation, reporting needs, privacy regulations, and general organization versatility.

When picking a jurisdiction for your overseas company, a number of variables need to be considered to make certain the decision straightens with your tactical objectives. One essential facet is the tax routine of the territory, as it can have a substantial effect on the company's earnings. In addition, the level of regulative conformity required, the political and financial stability of the jurisdiction, and the simplicity of working should all be examined.

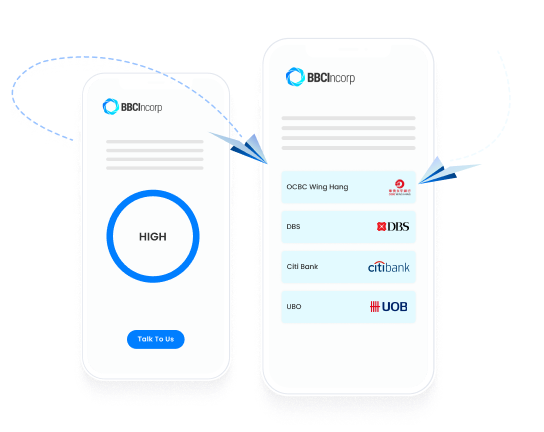

Moreover, the credibility of the territory in the global business neighborhood is necessary, as it can affect the assumption of your firm by customers, partners, and monetary institutions - offshore company formation. By meticulously assessing these elements and seeking expert recommendations, you can pick the right jurisdiction for your offshore business that enhances cost-effectiveness and supports your service goals

Structuring Your Firm Effectively

To make sure ideal performance in structuring your offshore firm, meticulous focus should be given to the business framework. By developing a clear possession structure, you can make sure smooth decision-making procedures and clear lines of authority within the business.

Following, it is necessary to take into consideration the tax ramifications of the picked framework. Different jurisdictions offer varying tax benefits and motivations for overseas companies. By thoroughly evaluating the tax regulations and guidelines of the selected territory, you can maximize your business's tax obligation efficiency and lessen unneeded expenditures.

Moreover, preserving appropriate documentation and documents is crucial for the efficient structuring of your overseas firm. By maintaining accurate and updated records of monetary transactions, company choices, and compliance files, you can make sure transparency and accountability within the organization. This not just promotes smooth procedures but also aids in demonstrating compliance with governing demands.

Leveraging Technology for Financial Savings

Reliable structuring of your offshore firm not only hinges on thorough interest to business frameworks yet likewise on leveraging technology for financial savings. In today's digital age, modern technology plays an essential role in enhancing processes, lowering expenses, and increasing effectiveness. One way to utilize technology for financial savings in offshore firm formation is by making use of cloud-based services for information storage and collaboration. Cloud technology gets rid of the requirement for pricey physical facilities, lowers you could look here maintenance prices, and provides versatility for remote job. Additionally, automation devices such as electronic signature platforms, accounting software, and project administration systems can considerably lower manual labor expenses and enhance total productivity. Accepting on the internet communication devices like video conferencing and messaging apps can likewise bring about set you back savings by minimizing the demand for travel costs. By incorporating technology strategically into your offshore business development procedure, you can attain significant savings while improving operational performance.

Minimizing Tax Liabilities

Utilizing critical tax obligation planning techniques can effectively reduce the financial problem of tax liabilities for overseas firms. One of the most usual approaches for lessening tax liabilities is via revenue moving. By distributing earnings to entities in low-tax jurisdictions, offshore firms can lawfully lower their total tax obligations. In addition, benefiting from tax motivations and exemptions supplied by the jurisdiction where the overseas business is signed up can lead to substantial financial savings.

One more approach to lessening tax obligation liabilities is by structuring the overseas company in a tax-efficient way - offshore company formation. This entails very carefully making the ownership and functional framework to optimize tax advantages. Setting up a holding company in a jurisdiction with positive tax obligation laws can help settle earnings and minimize tax obligation exposure.

Additionally, staying upgraded on worldwide go to this web-site tax obligation laws and conformity requirements is important for minimizing tax obligation liabilities. By guaranteeing stringent adherence to tax obligation regulations and regulations, offshore companies can avoid costly penalties and tax disputes. Seeking professional advice from tax consultants or legal experts specialized in international tax obligation issues can additionally supply useful understandings into efficient tax planning strategies.

Guaranteeing Compliance and Risk Mitigation

Executing durable compliance procedures is important for overseas companies to reduce threats and maintain regulative adherence. To make certain compliance and alleviate threats, offshore business need to conduct extensive due persistance on clients and company companions to protect against involvement in illicit activities.

In addition, staying abreast of changing guidelines and lawful needs is vital for offshore business to adjust their conformity practices appropriately. Involving lawful specialists or conformity consultants can offer useful support on browsing intricate regulatory landscapes and guaranteeing adherence to worldwide requirements. By prioritizing compliance and danger reduction, overseas business can improve transparency, develop depend on with stakeholders, and secure their procedures from possible legal effects.

Verdict

Using calculated tax obligation preparation methods can properly lower the economic burden of tax liabilities for offshore companies. By distributing profits to entities in low-tax jurisdictions, overseas firms can legitimately decrease their total tax obligation commitments. In addition, taking benefit of tax rewards and exemptions provided by the jurisdiction where original site the offshore business is registered can result in considerable cost savings.

By guaranteeing strict adherence to tax laws and regulations, overseas firms can prevent expensive penalties and tax disagreements.In verdict, cost-efficient overseas company formation calls for cautious consideration of territory, reliable structuring, innovation usage, tax obligation reduction, and compliance.